Us payroll tax calculator

Enter your info to. Free Unbiased Reviews Top Picks.

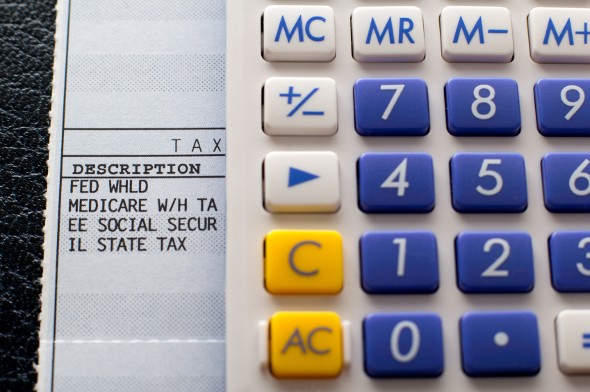

Understanding Payroll Taxes And Who Pays Them Smartasset

Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

. Ad Compare This Years Top 5 Free Payroll Software. Get Started With ADP Payroll. This places US on the 4th place.

Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Discover The Answers You Need Here. All Services Backed by Tax Guarantee.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Lets be honest - sometimes the best payroll tax calculator is the one that is easy to use and doesnt require us to even know what the payroll tax formula is in the first place. 1 The paycheck module caters to wage earners who want to see their take-home salary with most pre-tax and post-tax deductions.

You can enter your current payroll information and deductions and. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Gross Pay Calculator Plug in the amount of money youd like to take home.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

2 The estimated tax. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. This number is the gross pay per pay period.

Get Started With ADP Payroll. Could be decreased due to state unemployment. But if you want.

Medicare 145 of an employees annual salary 1. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdwon ito hourly daily weekly monthly. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Get the Latest Federal Tax Developments. The app has three modules. Subtract any deductions and.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. It only takes a few.

Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. But with a Savings.

The standard FUTA tax rate is 6 so your. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. US Income Tax Calculator 2022 The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

See where that hard-earned money goes - with Federal. Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. Financial Facts About the US.

Taxes can really put a dent in your paycheck. Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings. Ad Process Payroll Faster Easier With ADP Payroll.

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Discover ADP Payroll Benefits Insurance Time Talent HR More.

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Do I Need To File A Tax Return Forbes Advisor

Understanding Payroll Taxes And Who Pays Them Smartasset

Paycheck Calculator Take Home Pay Calculator

Tkngbadh0nkfnm

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Federal Income Tax Fit Payroll Tax Calculation Youtube

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Taxable Income H R Block

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet